CGA Law Firm has established an online municipal law resource center to provide guidance and address legal concerns.

Best Practices and Pitfalls When Adopting Noise Ordinances

| Whether it’s a case of an incessantly barking dog or an over-enthusiastic DIY warrior running power tools at midnight, most municipalities could use a carefully constructed noise ordinance from time to time. A well-written ordinance is clear, targeted, and most importantly, enforceable. An effective noise ordinance should be clear and understandable to the average person. A municipality is well within its authority to adopt a noise ordinance. Under Pennsylvania law, municipalities have the authority “[t]o make regulations as may be necessary for the health, safety, morals, general welfare and cleanliness and beauty, convenience, comfort and safety of the borough.” (8 Pa.C.S. § 1202). Noise pollution is a widely recognized health concern and regulated by the EPA under the federal Clean Air Act as well as by OSHA in the workplace. As with all ordinances, however, there is a possibility of a challenge on the grounds that it is unconstitutionally vague. In Phillips v. Borough of Folcroft, Pa., the Court found that an ordinance prohibiting “unnecessary noises” had led to the “arbitrary application” of police power. By creating an ordinance that is sufficiently clear to the average person, a municipality will avoid this risk. Read more: https://www.cgalaw.com/knock-it-off-best-practices-and-pitfalls-when-adopting-noise-ordinances/ Summer Associate Asahel Church can be reached directly at (717) 848-4900, Ext. 152 or by email: [email protected]. |

| For more information on municipal or any of our other area of law, please contact a CGA attorney. |

Sunshine Act Amendment

By Paralegal Christine Bland

| The Sunshine Act was amended by Act 65 of 2021 providing new requirements for publishing and posting public meeting agendas and new restrictions on when public bodies may vote on at meetings on matters not listed in the published agenda. These Amendments to the Sunshine Act are effective August 29, 2021. Follow this link to learn more: https://www.cgalaw.com/sunshine-act-amendment/ |

If you have any questions, please contact your CGA Law Firm Municipal attorney.

Municipal Law Paralegal Christine Bland

Christine may be reached directly at (717) 848-4900, Ext. 130 or by email: [email protected].

| For more information on municipal or any of our other area of law, please contact a CGA attorney. |

Financial Assistance for PA Municipalities from the American Rescue Plan Act of 2021

By Paralegal Christine Bland and Attorney Tim Bupp

| Last week the latest COVID-19 relief legislation, The America Rescue Plan Act of 2021, was passed by the U.S. House and signed into law by President Biden. In addition to the direct relief that many Americans are receiving this week, States, Cities, Counties, and Local Governments will also be receiving relief funds. This means that Pennsylvania townships, boroughs, and small cities will receive a piece of the 1.9 trillion dollars to be distributed by the Act under Section 603. Almost all townships, boroughs, and small cities in Pennsylvania will likely share in one pot of money to be allocated to each municipality based on its population. Each municipality’s allocation will be capped to not exceed the amount equal to 75% of the most recent budget for the municipality as of January 27, 2020. These relief funds will not be paid directly to the municipalities. Instead, the funds will first come proportionally to the State and then the State is required to distribute the funds to each municipality within 30 days. States can request additional extensions to make the distributions. The funds will be released in two distributions from the Federal Government. The first 50% distribution is to be made to the State within 60 days of when the Act was enacted and the other 50% distribution is to be made to the State within one year of the first distribution. Therefore, municipalities will likely not start seeing these funds until closer to June or July 2021 with the second distribution to take place sometime in 2022. There is no application process or sign-up requirement for the municipalities to receive these funds. However, there will be reporting required by municipalities since the Act requires a municipality to submit reporting to the Federal Government on the use of the funds received. The exact reporting requirements will likely be finalized in the coming weeks or months. There are limitations on the use of the funds. Municipalities must use all relief funds by December 31, 2024, and these funds must only be used: |

- to respond to the public health emergency concerning the Coronavirus Disease 2019 (COVID–19) or its negative economic impacts, including assistance to households, small businesses, and nonprofits, or aid to impacted industries such as tourism, travel, and hospitality;

- to respond to workers performing essential work during the COVID–19 public health emergency by providing premium pay to eligible workers of the municipality that are performing such essential work, or by providing grants to eligible employers that have eligible workers who perform essential work;

- for the provision of government services to the extent of the reduction in revenue of such municipality due to the COVID–19 public health emergency relative to revenues collected in the most recent full fiscal year of the municipality before the emergency; or to make necessary investments in water, sewer, or broadband infrastructure.

Note the funds cannot be used to make deposits into pension funds or to offset revenue resulting from a tax cut. Funds can be transferred from the municipality to private nonprofit groups, public benefit corporations involved in passenger or cargo transportation, special-purpose units of state or local governments, or back to the State.

Based on the evolving nature of the Coronavirus pandemic legislation CGA will keep you informed as additional information is released about Local Government relief funding and the American Rescue Plan Act of 2021. If you have questions about how the American Rescue Plan Act of 2021 impactsthe municipality you serve contact your CGA Attorney or Attorney Beth Kern.

If you have any questions, please contact your CGA Law Firm Municipal attorney.

Attorney Beth Kern

Beth may be reached directly at (717) 848-4900, Ext. 171 or by email:[email protected].

Governor’s Office Revises Covid-19 Restrictions

| Governor Wolf’s office recently issued an Order effective March 1, 2021, revising some previously-implemented Covid-19 restrictions. The amendment comes as a response to the recent decline in Covid-19 cases, and accompanying increase in hospital and medical center capacity. The steady pace of Covid-19 vaccine inoculations also supports the trend toward lessening restrictions, as the effects of the epidemic begin to recede. Most notably, the new Order lessens the previous restrictions on “Requirements for Events and Gatherings” stated in the guidance issued November 27, 2020, which limited attendance in indoor facilities holding less than 2,000 people to ten (10%) of the room’s capacity. The new Order expands that limit to fifteen (15%) percent of capacity, effective March 1, 2021. Restrictions on attendance of outdoor events for less than 2,000 people are also increased from fifteen (15%) percent to twenty (20%) percent of allowed capacity. Restrictions on larger gatherings, both indoor and outdoor, have been similarly loosened. These changes will affect the requirements imposed upon halls and facilities owned by municipalities and rented or provided to the public. Municipalities should continue to require those who utilize halls to observe the restrictions put in place by the Governor’s Order; and to also follow guidance on social distancing and other safety practices, for everyone’s benefit. Municipalities should also keep in mind that, while municipal meetings are exempted from some restrictions of the Governor’s Order, it only makes good sense to protect those who attend public meetings by limiting attendance, operating by remote on-line attendance where possible, and requiring those at meetings to follow safety protocol. It is important to note that while recent progress in Covid numbers indicates improvement, the epidemic is not yet over, and everyone should continue to take seriously this very real threat to all of us. Observance of required restrictions, mask-wearing, social distancing, and other safety precautions will help assure that our loved ones, our community, and our nation will continue to recover from the dangers of the past year. If you have questions or concerns about the effects of the Governor’s latest order, contact the CGA Law Firm Municipal Law Practice Group. Contact a CGA Municipal Law Attorney Attorney Steve McDonald  Steve McDonald Bio Steve may be reached directly at (717) 718-3978 or by email: [email protected]. Municipal Law Paralegal, Christine Bland  Christine may be reached directly at (717) 718-7130 or by email: cbland@cgalaw.com. |

| For more information on municipal or any of our other area of law, please contact a CGA attorney. |

New Guidance on Public Meeting Capacity

By Paralegal Christine Bland and Attorney Tim Bupp

| Municipalities have recently received clarification related to the crowd capacity allowed at public meetings. Previous guidance received from the Governor’s Office did not make clear whether local government meetings such as board meetings or zoning hearings were subject to the attendance restrictions placed on general public meetings. Government Meetings Some confusion resulted from whether governmental units were subject to or exempted from such limits. For example, as recently as last month, the Commonwealth websites’ FAQ indicated that school board meetings were subject to the state’s gathering limitations. Now, new guidance released from the Governor’s Office makes clear that local government meetings are exempted from any earlier gathering restrictions suggested or imposed by order of the Governor. Placing Reasonable Limitations However, municipal leaders should bear in mind that gathering limitations are a matter of public safety, which should always be of the highest priority to the municipality. It is simply good practice to consider placing reasonable limitations on public attendance as the epidemic continues into the winter flu season. Social Distancing Safe social distancing of at least six feet between attendees will necessarily require municipalities to limit the spread of chairs in their meeting room appropriately. If possible, municipal leaders should choose to meet in a large and well-ventilated room such as a gymnasium or auditorium. And requiring attendees to wear masks is not just a good safety idea, it is specifically identified in CDC Guidance as the best action we can all take to keep ourselves, our residents, and our loved ones safe. We look forward to continuing to work with your team as we keep everyone safe in the coming year. |

If you have any questions, please contact your CGA Law Firm Municipal attorney.

Paralegal Christine Bland

Christine may be reached directly at (717) 718-7130 or by email:[email protected].

Attorney Tim Bupp

Tim may be reached directly at (717) 887-7504 or by email:[email protected].

Administration Restates That Municipalities Are Exempt from Current Gathering Limits

| After requests for clarification from PSATS, the Wolf Administration has restated that municipalities were exempt from the original COVID restrictions/orders and remain so. Accordingly, they are no t required to comply with the commonwealth’s current gathering limits. Townships should, however, consider following the guidance in the current worker safety orders, such as reducing capacity by 50%. For more information, visit: https://www.governor.pa.gov/wp-content/uploads/2020/04/20200415-SOH-worker-safety-order.pdf |

| For more information on municipal or any of our other area of law, please contact a CGA attorney. |

Great News! Remote Notary Becomes Permanent in PA

By Paralegal Deb Werner and Attorney Tim Bupp

| In welcome news from Harrisburg, Governor Wolf has signed into law Act 97 of 2020, making the emergency provisions of remote on-line notary permanent. Previously, the remote notary provisions were set to expire sixty days after the expiration of the Governor’s declared emergency regarding the Covid-19 epidemic. Now Pennsylvanians will continue to benefit from the opportunity to sign remotely-notarized documents from the safety of their own home. Notarizing Electronically Remote notary is simple, inexpensive and safe. The signer, notary, and witnesses all join an on-line meeting, and the signing of documents and notarial act are all completed electronically. The process can take as little as ten minutes, and completed documents are provided electronically to the signor within the hour. No travel or attendance is required. As long as the signer has reliable internet service and can complete a straightforward identification process, the entire signing can be completed from the safety and comfort of their own home. This service can be provided to residents outside of the Commonwealth, including those serving abroad in the armed forces, to complete estate planning documents, real estate transactions, or other legal actions. CGA can help CGA Law Firm has experienced paralegals and up-to-date technology to provide this safe, convenient and efficient notary process to you. Please consider using remote notary for your next transaction. We will be happy to assist you! |

If you have any questions, please contact your CGA Law Firm Municipal attorney.

Paralegal Deb Werner

Deb may be reached directly at (717) 718-3951 or by email:[email protected].

Attorney Tim Bupp

Tim may be reached directly at (717) 887-7504 or by email:[email protected].

Gov. Wolf Renews COVID-19 Disaster Declaration

| On September 1, 2020, Governor Tom Wolf signed a second renewal of the 90-day disaster declaration for the COVID-19 pandemic. The emergency was originally declared on March 6, and this action is the second 90-day extension. The declaration extends protections for individuals and businesses during the ongoing pandemic. Protections include additional unemployment compensation, restrictions on eviction, an extension of licensing, and benefits for care workers and others who provide life-sustaining services to children, senior citizens, and other vulnerable residents. For more information, visit: https://www.cgalaw.com/covid-19-update-gov-wolf-renews-covid-19-disaster-declaration/ |

| For more information on municipal or any of our other area of law, please contact a CGA attorney. |

Open Space and Land Preservation Grant Program

By Attorneys Steve McDonald and Tim Bupp

| The York County Planning Commission (YCPC) has announced the launch of the County’s Open Space and Land Preservation Grant Program. The program is funded with County tax dollars and is designed to support open space preservation, resource protection, and outdoor recreation, with the objective of assisting the County to achieve its goal of preserving worthy York County land. Funds for Local Preservation The program is open to York County municipalities and non-profit organizations which support open space preservation and natural resource protection. Funds can be used for acquisition of property; but funding does NOT support the purchase or construction of improvements on properties. The County’s Program has availability of approximately $350,000 in resources total, and the grants are limited to a maximum of $100,000 per application. Program funds can be used for property acquisition price, including acquisition fees not to exceed ten percent of the total cost. Staff costs and entity overhead are not reimbursable costs. The program requires a fifty percent match for County funds; projects with a match exceeding 50% will receive special consideration. |

If you have any questions, please contact your CGA Law Firm Municipal attorney.

Attorney Steve McDonald

Steve may be reached directly at (717) 718-3978 or by email:[email protected].

Attorney Tim Bupp

Tim may be reached directly at (717) 887-7504 or by email:[email protected].

Statement of Financial Interest Filing Update

| “Pursuant to Section 1104(a) of the Public Official and Employee Ethics Act, 65 Pa. C.S. §1104(a), the statutory deadline for filing Statements of Financial Interests for calendar year 2019 is May 1, 2020. However, due to the COVID-19 pandemic, the Commission has determined that complete and accurate Statements of Financial Interests for calendar year 2019 which are filed between May 2, 2020 and July 15, 2020 will not be subject to compliance proceedings initiated by the Commission.” For more information, visit www.ethics.pa.gov |

If you need advice on complying with the Public Official and Employee Ethics Act during the current Emergency, reach out to a CGA Municipal Law Attorney.

New Advice Summary Relating to the Right-to-Know Law

By Jasmine Butler

Pursuant to the Right-to-know law (RTKL) Advisory, the Office of Open Records (OOR) has new advice for agencies within “yellow” status counties. These agencies should continue processing RTKL requests and appeals as usual. If an appeal is negatively affected by the COVID-19 pandemic, and the agency or requestor cannot meet a required deadline, the OOR may prolong the appeal deadline. In particular, agencies located within a county transitioning into “yellow” status may need to provide evidence showing why the appeal deadline needs to be extended.

In regards to offices being closed, any day that falls within an office closure is not considered a “business day.” Therefore, it is not counted toward the five business day time limit associated with an agency’s response time to requests under the RTKL. Although an office may be closed to the public, it may not reflect a full RTKL closure of operations. All appeals will be assessed on an individual basis and measured on its merits.

If you have any questions, please contact your CGA Law Firm Municipal attorney.

Jasmine Butler, 2020 Law School Graduate

HANDLING RIGHT-TO-KNOW LAW ISSUES DURING THE COVID-19 EMERGENCY

By Jasmine Butler, Law Clerk, and Christine Bland, Paralegal

| While the Right-to-Know Law (RTKL) continues to be in effect for most municipal entities, its function has been temporarily suspended for the Commonwealth due to the current COVID-19 emergency. Pursuant to Section 901 of the law, all requests must receive a response within five business days – excluding days closed for business. If an agency faces “bona fide issues” related to this pandemic, the Pennsylvania Office of Open Records’ (OOR) advisory permits temporary suspensions exceeding the scope of that law. The OOR recommends the agency seek their solicitor’s advice before taking this recourse. Under Act 15, municipalities operating under an emergency declaration should continue to strive for transparency. Though agencies are encouraged to timely process requests if feasible, when unable to do so they should also notify the public of their strategy. While Act 15 provides temporary relief from some RTKL requirements, compliance is of course the best practice. When compliance is impossible an emergency or Continuity of Operations Plan (COOP) can be implemented; this strategy must specifically address how RTKL requests will be handled moving forward. For instance, implementing an automatic email in response to RTKL requestors, providing a notification on the agency’s website regarding a delay, or mailing letters to requestors about longer response times are all COOP options. Several agencies have failed to do so, leaving the Senate no choice but to subpoena the administration and mandate documentation production. |

If you need advice on complying with the RTKL during the current Emergency, reach out to a CGA Municipal Law Attorney.

ACT 15 of 2020 — A Primer for Municipalities

By Evan Gabel

On Monday, April 20th, 2020, Governor Tom Wolf signed Act 15 2020 (the “Act”), which, among other things, has significant implications for the administration of local government in Pennsylvania for the duration of the Disaster Emergency that was declared on March 6th, 2020.

Specifically, the Act addresses three issues relevant to local government. Follow the link below to learn more.

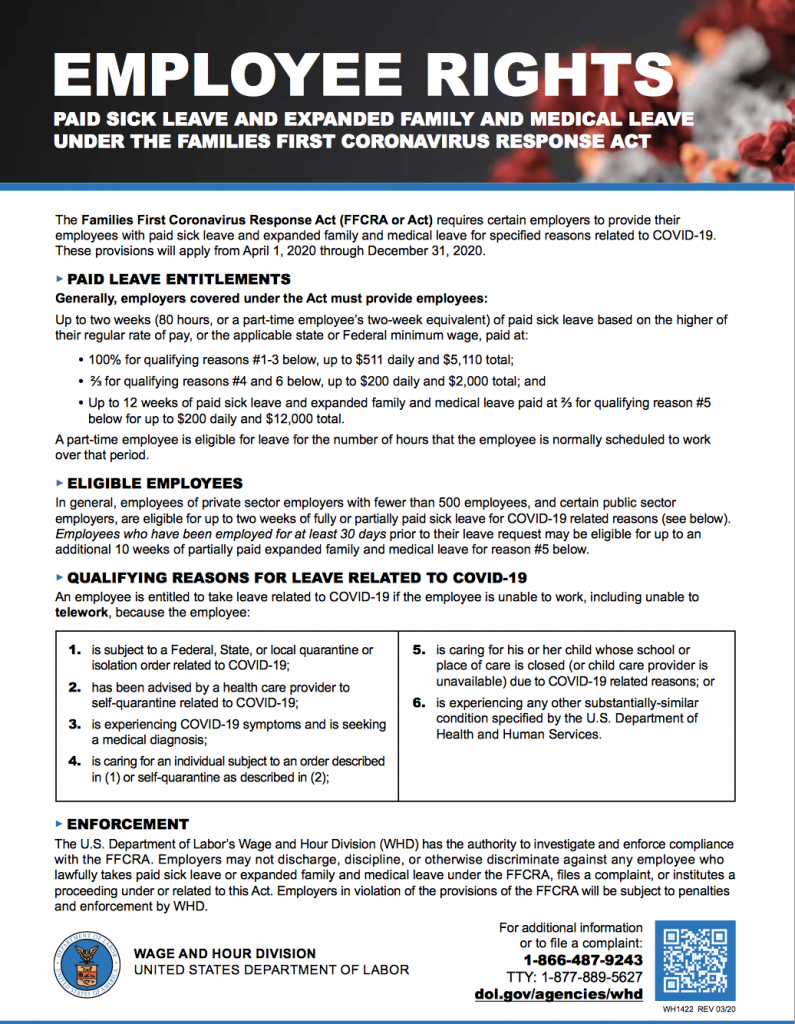

U.S. Labor Department Releases Labor Law Poster for Employee Rights under FFCRA

By Craig Sharnetzka

| The U.S. Department of Labor has released a new labor law poster detailing employee rights under the Families First Coronavirus Relief Act. Townships and Boroughs should print and post this document in their workplaces. Click here for the poster. Please note that to the extent any employer has employees working remotely, posting the notice in the workplace alone will not be sufficient – they will need to email or mail the notice to anyone not physically in the workplace. They may also post on an employee accessible website – but if they do that, notice should be given to each employee advising that it has been posted. |

Business Closure Enforcement Guidance

By Attorney Tim Bupp

On March 19, 2020, Governor Tom Wolf and Secretary of Health Dr. Rachel Levine ordered all non-life-sustaining businesses in Pennsylvania to close their physical locations to reduce the spread of COVID-19. The closure order took effect on March 19 at 8 PM.

The closures are enforceable through criminal penalties, under the Disease Control and Prevention Law of 1955 and the Administrative Code of 1929.

Follow the links below to learn more or download the Business Closure Order Enforcement Guidance.

Guidance Regarding Memo on House Bill 1564

By Evan Gabel

| As some of you may be aware, a memo has been circulating regarding Pennsylvania House Bill 1564, which proposes to allow municipalities to conduct fully electronic meetings, as well as suspending some permit application deadlines, among other things. The memo that indicates that the Pennsylvania municipal codes have been amended by House Bill 1564. This, unfortunately, is simply not true. |

COVID-19 and Public Meetings

By Attorney Craig Sharnetzka

Both the Borough Code and Second Class Township Code require the respective governing bodies meet at least once a month. The Sunshine Act requires the meetings be open to the public and held at public building. Therefore, the following guidance is provided regarding conducting Borough Council meetings and Board of Supervisors meetings at this time.

Townships and Boroughs should continue to hold regular monthly meetings unless a closure order is issued.

Emergency Declaration

If an official emergency declaration prevents that from happening, a meeting via teleconference, webinar, or other electronic method that allows for two-way communication is permissible for Townships. There must be a way for the public to participate and comment. The Sunshine Act allows for the public to provide comment at the next meeting. One electronic option would be to use Facebook live. The municipality holding the meeting should record it and make the recording available to the public.

Telecommunication

Boroughs can provide for limited participation by electronic means, per the Borough Code. Non-physical participation is allowed council members by telecommunication only if a majority of membership of council in office is present at the physical meeting location and quorum is present at the convening of the meeting. Council may only authorize telecommunication participation for the following reasons: illness or disability of the member of council; care for the ill or newborn in the member’s immediate family; emergency; and family or business travel.

Non-Essential Meetings Canceled

Any meetings that are not required to be held by law, such as committee meeting, municipal planning commission meetings could be canceled.

Safety Measures

It is suggested that governing bodies to continue to hold their meetings, but that social distancing be adopted and changes be made to meetings, such as reducing agenda items to only those that are critically important. Here are some suggestions:

· Practice social distancing,such as no longer shaking hands and staying six feet apart. Clean and disinfect the meeting room before and after the meeting. Clean frequently touched surfaces daily, ensure that bathrooms have adequate soap and drying materials, and make hand sanitizer available throughout your facilities.

· Municipal officials and employees who are sick or in an at-risk health category should participate in the meeting via remote means.

· To encourage less in-person attendance, provide alternative means for public comment, such as posting the agenda on websites and social media before the meeting and providing an email address where comments may be submitted in advance. Another option could be a call-in number to provide comments during the meeting.

Issues that Need to Be Addressed Now

PSATS and other groups are working with the General Assembly and the Governor’s office on issues that need to be addressed now, such as authorization to do fully remote meetings, and a waiver of mandatory timeframes for approving land use plans, performing UCC reviews, and responding to RTKL requests. Please share your concerns with PSATS and PSAB and with your state legislators as well.

Follow the links below to learn more.